2025 Exam Changes

WHat you need to know

Change Overview

> The New Exam will launch for the testing window starting in January 2024.

> The New Exam will now consist of 3 Core exam sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Taxation and Regulation (REG).

> The New Exam will consist of 3 Discipline exam sections: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC) and Tax Compliance and Planning (TCP).

> The Exam will have an increased emphasis on testing higher order skills that include, but are not limited to, critical thinking, problem-solving and analytical ability.

> Each section will have a blueprint illustrating the content knowledge and skill levels that may be tested on the Exam, which are, in turn, linked directly to tasks that are representative of the work of a newly licensed CPA.

> More task-based simulations (TBSs) will be used to test a combination of content knowledge and higher order skills, which will include aspects of professional skepticism as appropriate.

> Total Exam testing time will increase from 14 to 16 hours — four sections of four hours each (3 Core + 1 Discipline)

Exam Design

The Uniform CPA Examination (the Exam) is comprised of Eight sections, each four hours long:

The 3 Core exam sections, each four hours long, are: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Taxation and Regulation (REG).

The 3 Discipline exam sections, each four hours long, are: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC) and Tax Compliance and Planning (TCP).

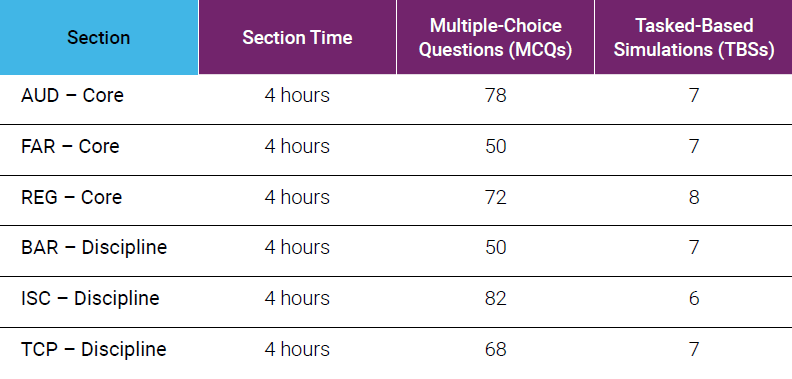

The table below presents the design of the Exam by section, section time and question type.

Exam Scoring

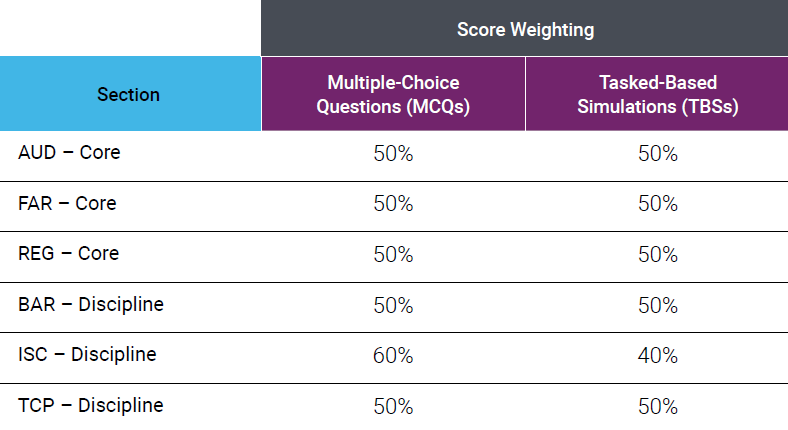

The table below presents the scoring weight of multiple choice questions (MCQs), task based simulations (TBSs) and written communication for each Exam section.

Higher Order Skills

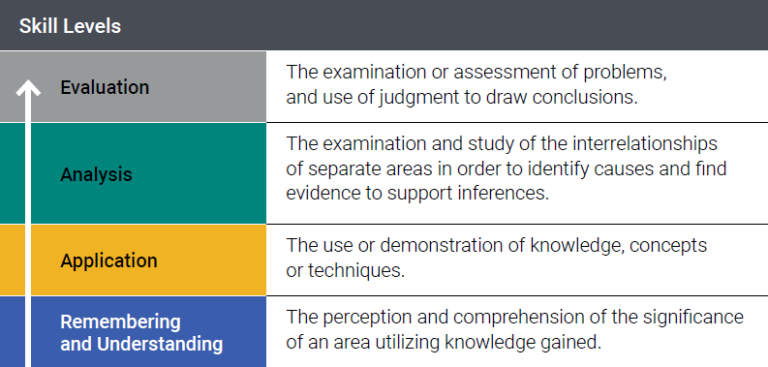

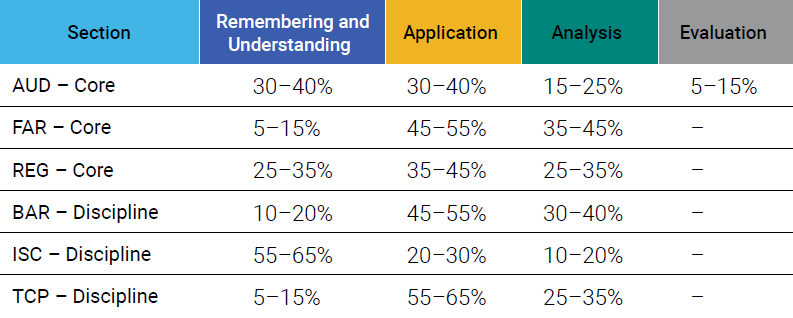

Approximately 600 representative tasks that are critical to a newly licensed CPA’s role in protecting the public interest have been identified. The representative tasks combine both the applicable content knowledge and skills required in the context of the work of a newly licensed CPA. Based on the nature of a task, one of four skill levels, derived from the revised Bloom’s Taxonomy, was assigned to each of the tasks, as follows:

2025 exam changes

Read about the various changes the AICPA has approved for the 2025 CPA Exam

Scheduling your Exam

Find out about Scheduling your CPA Exam, Testing Windows and Costs of Taking your Exam

Exam Scoring

Find out Where to get your Scores, Passing Rates & When Exam Scores are Released

Exam application process

Learn about what you need to be Eligible to sit for the CPA Exam & How to Apply

Exam Content

Find out what Content to Expect from each Section of the Exam & How the Exam is Structured

It is possible. Together.

If You are Ready to Pass...We are Here for You.