Exam Content

WHat you need to know

Exam Design

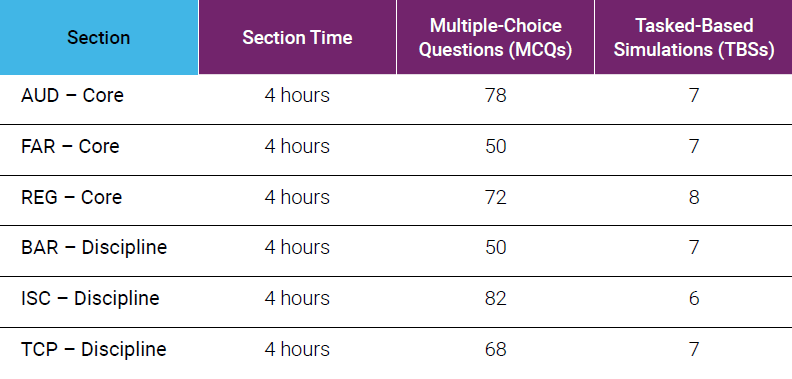

> The New Exam will now consist of 3 Core Exam Sections: Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR) and Taxation and Regulation (REG).

> The New Exam will consist of 3 Discipline Exam Sections: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC) and Tax Compliance and Planning (TCP).

> The Uniform CPA Examination (the Exam) is comprised of the 3 Core Sections plus 1 Discipline Section of your choice.

The table below presents the design of the Exam by section, section time and question type.

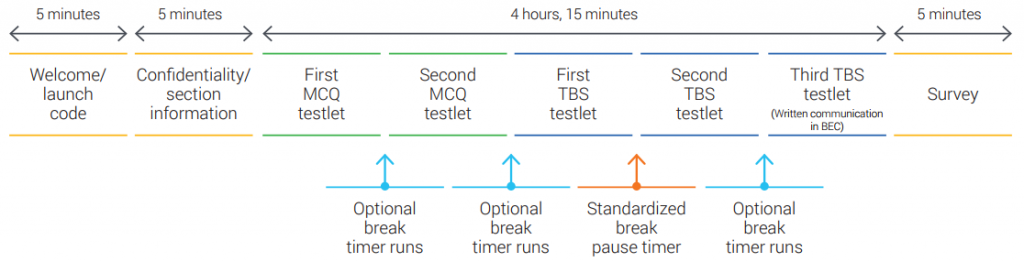

• 5 minutes — Welcome/launch code

• 5 minutes — Confidentiality/section information

• 4 hours — Testing time

• 15 minutes — Standardized break

• 5 minutes — Survey

Exam Structure

Approximately 600 representative tasks that are critical to a newly licensed CPA’s role in protecting the public interest have been identified. The representative tasks combine both the applicable content knowledge and skills required in the context of the work of a newly licensed CPA. Based on this required knowledge, each section of the exam has it’s own format structure.

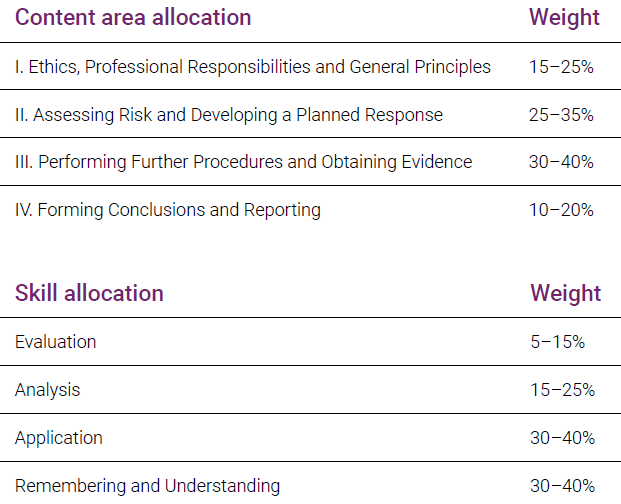

Audit

The Auditing and Attestation (AUD) section of the Uniform CPA Examination tests the knowledge and skills that a newly licensed CPA must demonstrate when performing:

> Audits of Issuer and Nonissuer Entities (including governmental entities, not-forprofit entities, employee benefit plans and entities receiving federal grants)

> Attestation Engagements for issuer and nonissuer entities (including examinations, reviews and agreed-upon procedures engagements)

> Preparation, Compilation and Review Engagements for nonissuer entities and reviews of interim financial information for issuer entities.

Newly licensed CPAs are also required to demonstrate knowledge and skills related to professional responsibilities, including ethics and independence. The engagements tested under the AUD section of the Exam are performed in

accordance with professional standards and/or regulations promulgated by various governing bodies.

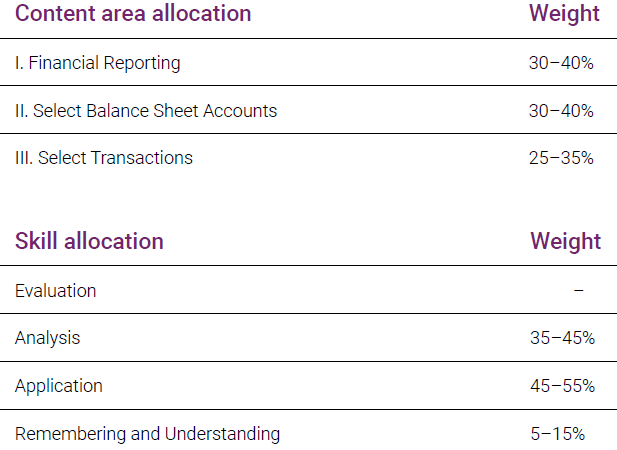

Financial

The financial accounting and reporting frameworks that are eligible for assessment within the FAR section of the Exam include the standards and regulations issued by the:

> Financial Accounting Standards Board (FASB)

> U.S. Securities and Exchange Commission (U.S. SEC)

> American Institute of Certified Public Accountants (AICPA)

> Governmental Accounting Standards Board (GASB)

> International Accounting Standards Board (IASB)

The Financial Accounting and Reporting (FAR) section of the Uniform CPA Examination (the Exam) assesses the knowledge and skills that a newly licensed CPA must demonstrate in the financial accounting and reporting frameworks used by business entities (public and nonpublic), not-for-profit entities and state and local government entities.

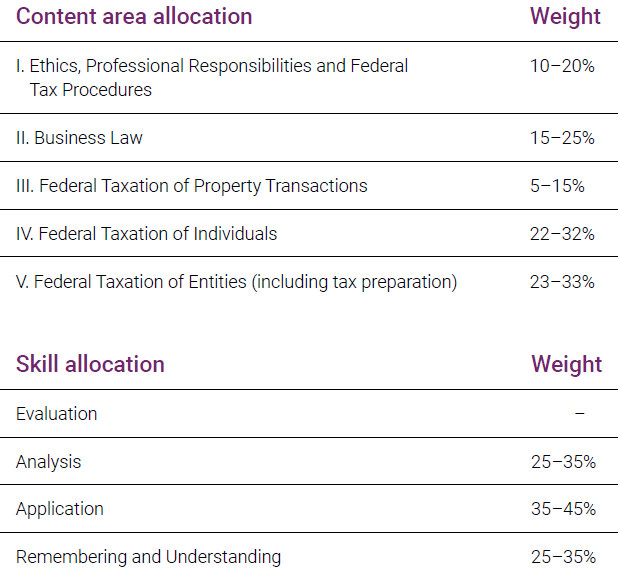

Regulation

The Regulation (REG) section of the Uniform CPA Examination (the Exam) tests the knowledge and skills that a newly licensed CPA must demonstrate with respect to:

> Federal Taxation

> Ethics and Professional Responsibilities Related to Tax Practice

> Business Law

The Regulation (REG) section of the Uniform CPA Examination assesses the knowledge and skills that a newly licensed CPA must demonstrate in analyzing & preparing taxes, Business Law, Ethics and Professional Responsibilities.

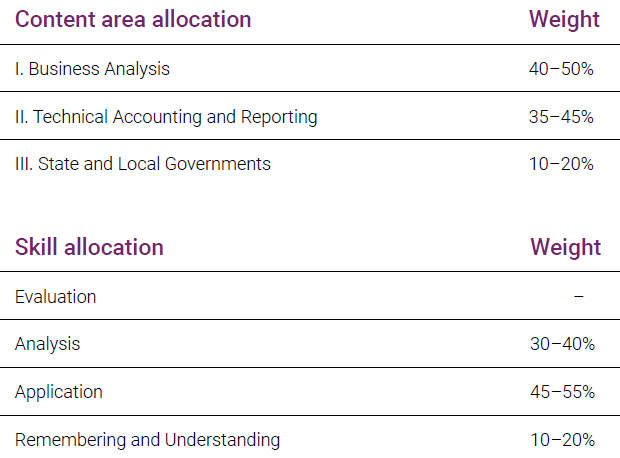

Business Analysis & Reporting

The Business Analysis and Reporting (BAR) section of the Uniform CPA Examination (the Exam) tests knowledge and skills that a newly licensed CPA must demonstrate when performing:

> Business Analysis

> Technical Accounting & Financial reporting

> State & Local Governments

> Other professional responsibilities in their role as certified public accountants

The content areas tested under the BAR section of the Exam encompass three diverse subject areas. These content areas are corporate governance, economic concepts and analysis, financial management, information technology, and operations management.

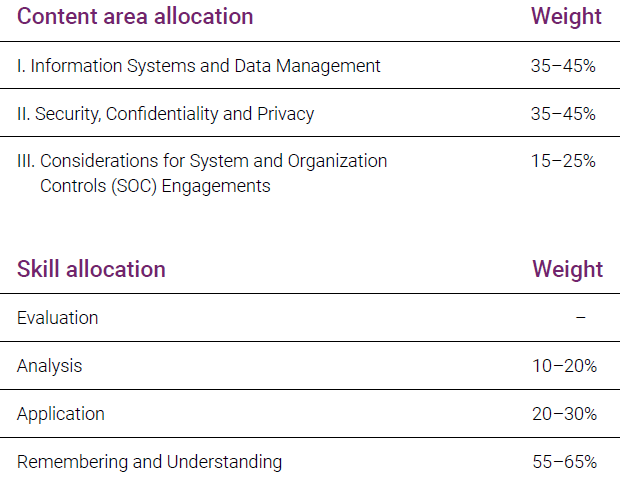

Information systems & Controls

The Information Systems & Controls (ISC) section of the Uniform CPA Examination (the Exam) tests knowledge and skills that a newly licensed CPA must demonstrate when performing:

> Information Systems & Data Management

> Security, Confidentiality & Privacy

> Considerations for System & Organization Controls (SOC) Engagements

The content areas tested under the ISC section of the Exam encompass three diverse subject areas. These content areas are Information systems, data management concepts and analysis, financial management, information technology, and operations management.

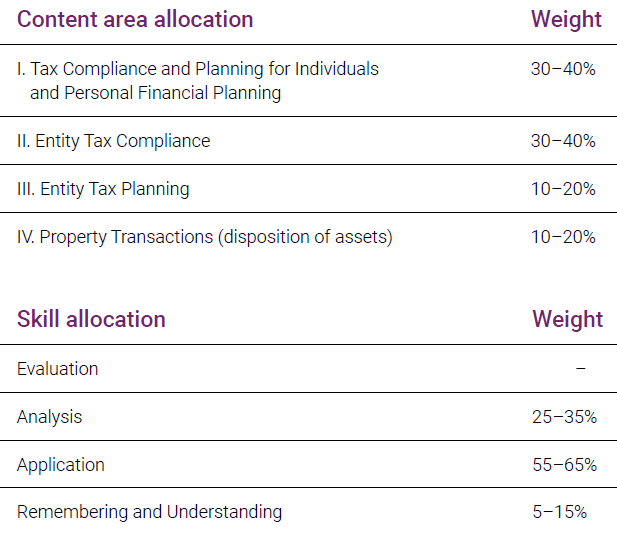

TAX COMPLIANCE & Planning

The Tax Compliance & Planning (TCP) section of the Uniform CPA Examination (the Exam) tests knowledge and skills that a newly licensed CPA must demonstrate when performing:

> Tax Compliance & Planning

> Entity Tax Compliance

> Tax Planning

> Property Transactions

The content areas tested under the TCP section of the Exam encompass three diverse subject areas. These content areas are tax compliance, entity tax concepts and analysis, financial management, information technology, and operations management.

2025 exam changes

Read about the various changes the AICPA has approved for the 2025 CPA Exam

Scheduling your Exam

Find out about Scheduling your CPA Exam, Testing Windows and Costs of Taking your Exam

Exam Scoring

Find out Where to get your Scores, Passing Rates & When Exam Scores are Released

Exam application process

Learn about what you need to be Eligible to sit for the CPA Exam & How to Apply

Exam Content

Find out what Content to Expect from each Section of the Exam & How the Exam is Structured

It is possible. Together.

If You are Ready to Pass...We are Here for You.